1099 Accounts Quickbooks For Mac

In 1099 preferences, the contribution account is listed with the drop box 'omit these payments from 1099'. Since revenue and expense accounts do not carry forward past the year-end closing (although the details are still retained by QuickBooks), one simple.

Hello there,, Currently, the option to e-file the 1099s in QuickBooks Desktop for Mac isn’t available. As a workaround, you’ll need to manually enter the data on the form and file these forms outside QuickBooks.

Just a gentle reminder, you can’t print 1099 forms on plain paper. You need preprinted forms to print on, and QuickBooks will fill in the information on the official form. You can print the 1099s and 1096s within QuickBooks to serve as your reference for the official 1099 forms. Here’s how: • Go to the File menu, then select Print Forms. • Choose 1099s/1096. • Select the date range for your forms. • Select the vendors you need to print forms for.

• Click Print 1096 or Print 1099. • A Print window appears with options that will be familiar to you if you’ve printed from other Mac software. Make any adjustments you want. • Click Print.

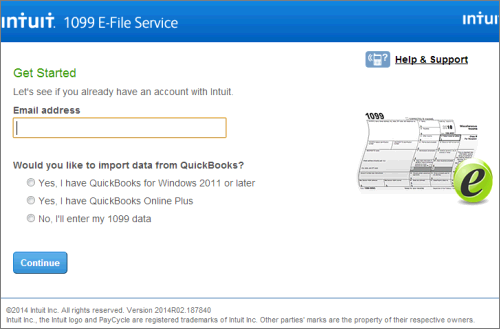

After printing their 1099-MISC Forms, you can hand write your vendors’ state information into Boxes 16 & 17 using a black ink pen before mailing their forms to their state. For more information, you can check out the page 226 on the. I’d also suggest using the to e-file your 1099-MISC forms with the IRS. No subscription or QuickBooks product is required to sign up into the 1099 Standalone E-File Service account. To learn more about 1099 forms, you can go through the article. You can also from the IRS website.

The options above will help you stay compliant in filing 1099 forms. If you need further assistance, don’t hesitate to comment below. Just remember, we’ve always got your back,! • • • • • • • Note that QuickBooks Mac will not have the proper totals for the 1099/1096s until Jan 1st 2019. For that reason it will restrict you to the prior year's data (2017 when likely what you want is 2018) up until that point. You can move your computer clock forward to trick it but of course anything not yet entered will be wrong. Also an update coming out shortly will update it for a change to the 1096 form layout when printing.

You can also export your company file to QuickBooks Windows format if you or your accountant has a copy of quickBooks Windows. I believe the data will come over correctly with the exception of WI and NJ state tax ids (if you have vendors in those States those are required). Finally if you use Intuit Online Payroll you can file your 1099s from there as long as you paid vendors via IOP. People come to QuickBooks Learn & Support for help and answers—we want to let them know that we're here to listen and share our knowledge. We do that with the style and format of our responses.

Here are five guidelines: • Keep it conversational. When answering questions, write like you speak. Imagine you're explaining something to a trusted friend, using simple, everyday language. Avoid jargon and technical terms when possible. When no other word will do, explain technical terms in plain English. • Be clear and state the answer right up front.

8 On the Boot Camp Assistant with the “Create a Windows 7 or later version install disk” selected, click Continue. It will ask you to plug in your USB memory stick if it is not already plugged in. Then locate the.iso file on your mac and click Continue (Note: All Data will be lost from your Memory stick). Create windows 7 boot disk for mac.

Ask yourself what specific information the person really needs and then provide it. Stick to the topic and avoid unnecessary details. Break information down into a numbered or bulleted list and highlight the most important details in bold. • Be concise. Aim for no more than two short sentences in a paragraph, and try to keep paragraphs to two lines. A wall of text can look intimidating and many won't read it, so break it up.

It's okay to link to other resources for more details, but avoid giving answers that contain little more than a link. • Be a good listener. When people post very general questions, take a second to try to understand what they're really looking for.

Then, provide a response that guides them to the best possible outcome. • Be encouraging and positive. Look for ways to eliminate uncertainty by anticipating people's concerns. Make it apparent that we really like helping them achieve positive outcomes.